In Malaysia Stamp duty is a tax levied on a variety of written instruments specifies in the First Schedule of Stamp Duty Act 1949. Ringgit Malaysia loan contracts are generally taxed with a stamp duty of 05.

Rental Agreement Stamp Duty Malaysia Speedhome

To make the tenancy agreement legal and admissible in court the LHDN Lembaga Hasil Dalam Negeri Malaysia needs to stamp it after the landlord and tenant have signed it.

. To be eligible for stamp duty remission under Paragraph 2 3 of the 2010 Order a sub-service agreement or sub-sub-service agreement must state. Stamp duty of a lease agreement. In Malaysia stamp duty is a tax levied on a.

Documents you need to sign 1 the sales and sales contract. On 6 November 2020 the Malaysian Finance Minister Tengku Datuk Seri Zafrul Tengku Abdul Aziz announced that for first-time home buyers there will be exemptions on the stamp duty for the. Iii For projects that are cancelled by the parties who had offered the contracts and stamp duty for all such contracts had been paid only the stamp duty at the Ad valorem rate will be.

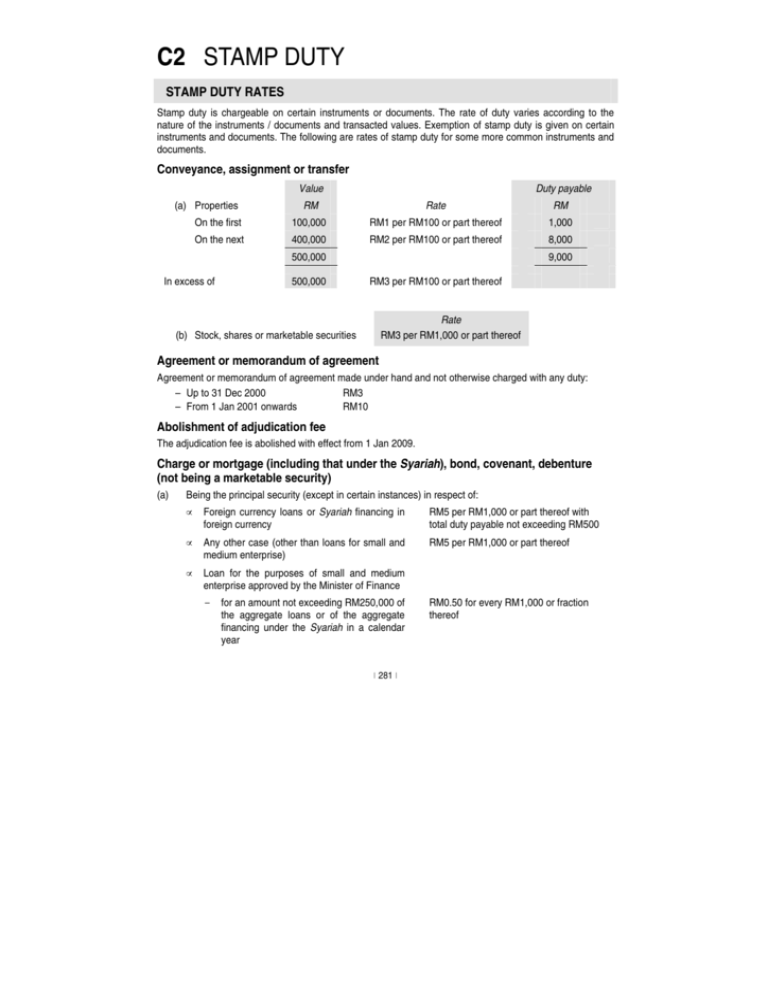

With regard to the Memorandum of Transfer the rates of the duty are as follows. BEWARE OF FAKE REVENUE STAMPS. 2 CKHT form form to be forwarded by seller and buyer to Inland Revenue Board Malaysia 3 Stamp Duty Form.

A 428 was gazetted on 25 November 2021 and is deemed to have come into operation on 28 December 2018. Below is the stamping fee calculation. Stamp duty only applies to sales contracts concluded from 1 July 2019 to 31 December 2020 by a legitimate Malaysian citizen.

It has to be based on the amount of. The exchange operator said MoF recently announced that the stamp duty is set at RM150 for every RM1000 or fractional part of RM1000 of the value of the contract note of. The Assessment and Collection of Stamp Duties is sanctioned by statutory law now described as the Stamp Act 1949.

Following the above the Stamp Duty Remission Order 2021 PU. So for a property priced at RM500000 you would typically apply for a 90 loan. Stamp duty on a loan agreement is a flat 05 rate applied to the full value of the loan.

A the names of the. The person liable to pay stamp duty is set out in the Third Schedule of Stamp Act 1949. RM1 for every RM1000 or any fraction thereof based on the transaction value increased to RM150 for every RM1000 or fractional part of RM1000.

An instrument is defined as any written document and in general- stamp duty is levied on legal commercial and financial instruments. For every RM100 or. The stamp duty chargeable on the Sale and Purchase Agreement is RM10 each.

It has to be stamped at LHDN Lembaga Hasil Dalam Negeri Inland Revenue Board. 1-year tenancy agreement RM1 for every RM250 of the annual rental above RM2400. RM10000 or 20 of the amount of the deficient duty whichever sum be the greater in any other case if the instrument is stamped beyond six months after the required time for stamping.

The stamp duty rate is prescribed under the Stamp Act 1949. Stamp duty of 05 on the value of servicesloans. In general term stamp duty will be imposed to legal.

STAMP MALAYSIA wwwhasilgovmy LEMBAGA HASIL DAI-AM NEGERI MALAYSIA LHDNMR1416. The stamp duty for a tenancy agreement in Malaysia is calculated as the following. Properties other than stocks or marketable securities.

Let us look into the rates of stamp duty in Malaysia. Rather than a single fixed fee stamp duty for tenancy agreements are calculated based on every RM250 of the annual rental. Based on the table below this means that for.

On the first RM 100000 RM 1 is collected per RM 100 which totals. Shares or stock listed on Bursa Malaysia. However for the following instruments.

This agreement here the contractinstrument of dealing is what needs to be stamped. The stamp duty Exemption 2022 as per the Budget 2021 announcement and further promoting homeownership especially for first-time buyers are below.

Legality Of Backdating Agreements

What To Remember About Stamp Duty In Malaysia

Sale And Purchase Agreement In Malaysia 4 Important Clauses To Note

Stamp Duty And Administration Fee 2 Important Aspects For Tenancy Agreement In Malaysia

Why Could This Green Chop Cost You Thousands Of Ringgit Asklegal My

Iproperty Stamp Duty Administration And Legal Fees For A Tenancy Agreement In Malaysia Laurelcap Group Trust Integrity Expertise

Tenancy Agreement Stamp Duty Table Tenancy Agreement Agreement Stamp Duty

C2 Stamp Duty Malaysian Institute Of Accountants

Property Nightmare Stories 10 Don T Diy Your Tenancy Agreement Property Stories Propertyguru Com My

Did You Know That Liabilities Under A Contract Cannot Be Assigned Case Facts By Hhq Law Firm In Kl Malaysia

Budget 2020 Stamp Duty On Foreign Currency Loan Agreement To Be Increased Raja Darryl Loh

Drafting And Stamping Tenancy Agreement

The Validity Of Unstamped Agreements In Malaysia Fareez Shah And Partners

Tenancy Agreement In Malaysia Complete Guide And Sample Download

Malaysia Law Firm With More Than 30 Lawyers Since 2009 In Pj Kl Johor Penang Perak Negeri Sembilan

Stamp Duty And Administration Fee 2 Important Aspects For Tenancy Agreement In Malaysia

Sale And Purchase Agreement In Malaysia 4 Important Clauses To Note

What Is The Stamp Duty On Rent Agreement Housing News

/document-with-title-escrow-agreement--687013664-bf0c2918820648dd9125ee95e82d62e6.jpg)